Is my foreign income taxable in India

income tax in India. The foreign income i.e. income accruing or arising outside India in any financial year is liable to income-tax in that year even if it is not received or brought into India. There is no escape from liability to income-tax even if the remittance of income is restricted by the foreign country.

Which income is taxable in India to non resident individual

All components of salary including allowances, perquisites and non-cash benefits are taxable unless specifically exempted. Certain deduction is available on salary income. The rental income received by an NR from property owned in India is taxable in India as its source is in India.

How much income is tax free in India

Budget 2023 has further tweaked the tax slabs under the new income tax regime. There will not be any tax for income of up to Rs 3 lakh. Income above Rs 3 lakh and up to Rs 5 lakh, will be taxed at 5 per cent. For income of above Rs 6 lakh and up to Rs 9 lakh, the income tax will be applicable at a 10 per cent rate.

Is income earned in Dubai taxable in India

As an NRIs in UAE, you are exempted from paying income tax in UAE. You do not have to pay any tased on your UAE Income in India too, under the UAE-India Double Taxation Avoidance Agreement. However, you must pay taxes on any income earned form investments in India.

Is foreign income taxable in India for NRI

In case of resident taxpayer all his income would be taxable in India, irrespective of the fact that income is earned or has accrued to taxpayer outside India. However, in case of non-resident all income which accrues or arises outside India would not be taxable in India.

Is online income taxable in India

Income Tax, a form of direct tax, is levied on the business profits. Any entity or residential individual running a business in India, whether online or through offline mode, is liable to pay taxes according to the entity's status.

Is NRI account taxable in India

Interest earned in the NRE account is exempt from tax for NRIs in India. If the NRI becomes a resident of India in a financial year, the entire interest would be taxable unless the taxpayer takes prior permission from RBI.

Should NRI pay tax in India

NRIs are required to file a return of income if they have taxable income in India. In the following situations, an NRI is required to file Income Tax Return in India: If your Gross Total Income before allowing any deductions under section 80 is more than Rs. 2,50,000.

How can I get tax exemption in India

Individuals can claim tax exemption for contributions made to specific relief funds and charitable institutions under Section 80G of the Income Tax Act, 1961. Can I get tax exemption for life insurance Income received from life insurance policy is exempted from tax under Section 10(10D) of the Income Tax Act, 1961.

Is 1 crore a good salary in India

Mint spoke to several 'crorepatis' aged between 27 years and 37 years about their lifestyles. Most of them believe that ₹1crore doesn't make them wealthy enough but unanimously agreed that the income gives them ample financial freedom.

How much money I can send to India in a year

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

Is income earned in Saudi Arabia taxable in India

An amendment in the Finance Act, 2021, initially caused confusion among Indian citizens working in the Gulf. However, it was clarified that the salary earned by Indian workers in Gulf countries such as Saudi Arabia, UAE, Oman, and Qatar remains exempt from Income Tax in India.

How much NRI salary is taxed in India

Tax Slabs for AY 2023-24

| Old Tax Regime | New Tax Regime u/s 115BAC | |

|---|---|---|

| Income Tax Slab | Income Tax Rate | Income Tax Rate |

| Up to ₹ 2,50,000 | Nil | Nil |

| ₹ 2,50,001 – ₹ 5,00,000 | 5% above ₹ 2,50,000 | 5% above ₹ 2,50,000 |

| ₹ 5,00,001 – ₹ 10,00,000 | ₹ 12,500 + 20% above ₹ 5,00,000 | ₹ 12,500 + 10% above ₹ 5,00,000 |

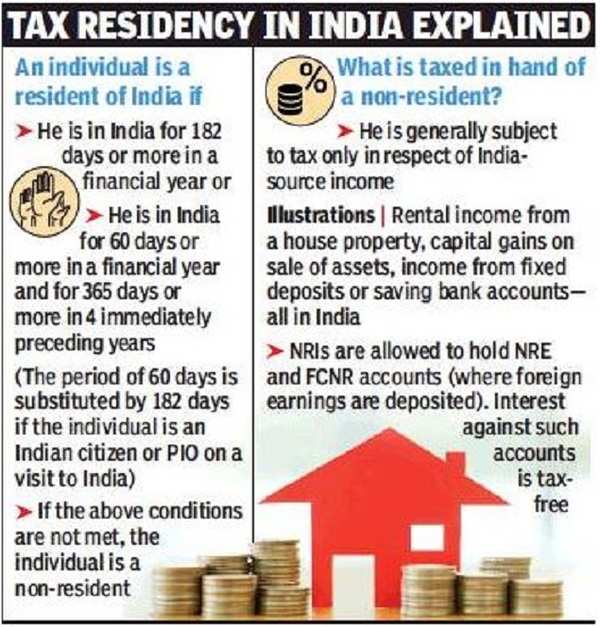

How many months can NRI stay in India

So, deriving from that, an NRI is one who is: Present in India for less than 182 days during that fiscal year, or. Present in India for less than 60 days during that fiscal year and cumulatively 365 days or less during the preceding four fiscal years.

Is foreign income taxable for freelancers in India

If you are a freelancer providing services to international clients, and they pay you in any currency apart from INR, eg. USD, EUR, or any convertible foreign exchange, then you have to pay 0% GST. For the services which are not on the list, taxation may vary and can range from 18%.

How much online transaction is taxable in India

The UPI and or e-wallet transactions are subject to taxes in the following situations: With UPI transactions, people can send or receive cash whenever needed. If the receipt is for a sum up to Rs 50,000, it is exempt from tax. Anything over that is treated as a gift and is taxable.

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

What is the tax limit for NRI in India

NRI Income Tax Slabs In India

| Taxable Income Range (Rs) | Tax Rate (%) |

|---|---|

| Equal/Less Than Rs 250,000 | Nil |

| Between Rs 250,000 To 500,000 | 5 |

| Between Rs 500,000 To 1,000,000 | 20 |

| More Than Rs 1,000,000 | 30 |

How much tax exemption is allowed in India

Income Tax Exemption Limit

| Income | General | Very senior citizens (above 80 years) |

|---|---|---|

| Up to Rs.2.5 lakhs | – | |

| Rs.2,50,001 to Rs.3,00,000 | 10%* | – |

| Rs.3,00,001 to Rs.5,00,000 | 10%* | – |

| Rs.5,00,001 to Rs.10,00,000 | 20% | 20% |

How can I save tax in India if my income is above 20 lakhs

There are various ways to save tax for those earning above ₹20 lakhs, including investing in tax-saving mutual funds, PPF, NPS, health insurance, donations to charity, home loan, rent paid, education loan, and offsetting expenses incurred on generating income from investments.

What is the top 1% salary in India

For India, the entry point is $1,75,000 or Rs 1.45 crore. In Asia, Singapore has the highest threshold with $3.5 million required to be in the top 1%, ahead of Hong Kong's $3.4 million. For the Middle East, the highest entry point is at UAE, estimated at $1.6 million.

What net worth is considered rich in India

48% of people who took the survey feel that having a net worth between 2-10 crores is necessary to be called RICH, with some even saying that the threshold should be set at 50 or even 100 crores. Let's forget about crores for a moment – what if your net worth is just $100,000 or approximately Rs.

How much money can NRI transfer to India

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Can I send 100k to India

There is no limit on sending money from USA to India. But, there is a limit of US $14,000 per person per year for tax free transactions. Any amount sent above US $14,000 per person per year, the sender is responsible for paying the taxes.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.