What are the causes of bank failure in India

The most common cause of bank failure is when the value of the bank's assets falls below the market value of the bank's liabilities, which are the bank's obligations to creditors and depositors. This might happen because the bank loses too much on its investments.

What is the biggest issue faced by the banks in India

Lack of banking for the underserved and rural population, which is approximately 69% of India's total population. Around 1.4 billion Indians do not have access to formal banking, as per the World Bank report. Lack of reach in rural areas, where technical enablement and use of financial services remain a big challenge.

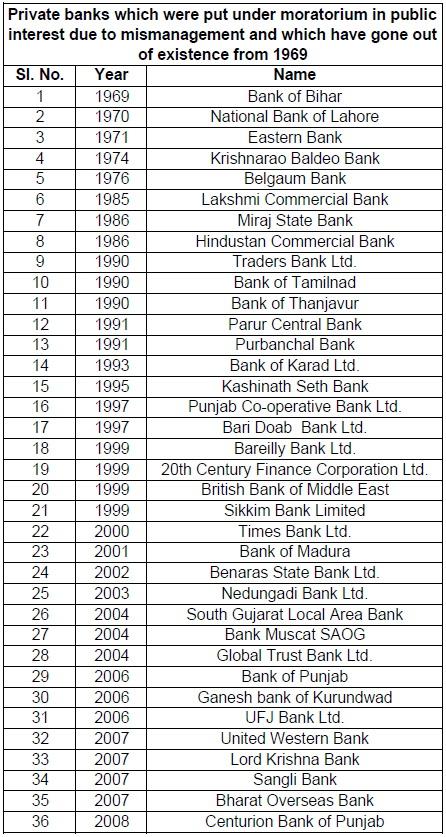

Which banks have failed in India

During the last three years, India has witnessed three bank failures — PMC Bank, YES Bank and Laxmi Vilas Bank. The regulator, with some hand-holding by the government, has not failed the depositors of any of them.

How many banks have collapsed in India

SVB-Signature Bank Collapse: How India handled 4 bank failures in last 20 years.

What are the 5 reasons for bank failure

Below are 5 reasons that may contribute to why banks fail.Poor Risk Management. One of the leading causes of bank failure is poor risk management.Asset Liability Mismatch. Banks borrow short-term funds from depositors and lend long-term to borrowers.Fraud.Economic Conditions.Lack of Supervision.

What is the main reasons why banks fail

A bank fails when a federal or state regulatory agency shuts it down. Failures happen when a bank cannot meet its obligations to its depositors or has taken on too much risk in its loan portfolio.

What are the risks faced by banks in India

All the transactions in a bank have one or more of the major risks such as liquidity risk, market risk, operational risk, credit/ default risk, interest rate risk, etc.

What are the factors affecting the banking industry in India

The banking industry faces a number of challenges such as frequent changes and developments in banking, technology, stringent prudential norms, increasing competition, high level of nonperforming assets, rising customer expectations, increasing demand on profitability, and increasing pressure on interest, liquidity and …

What happens if banks collapse in India

What Happens When A Bank Fails. If a bank fails in India, there is a bank deposit insurance cover of Rs 5 lakh per bank, which is available to depositors, and this amount has to be refunded within 90 days.

Which bank will never fail in India

RBI continues to classify SBI, ICICI Bank and HDFC Bank in the category of D-SIBs. But, what are D-SIBs These are the banks which are so important for the country's economy that the government cannot afford their collapse. Hence, D-SIBs are thought of as “Too Big to Fail" (TBTF) organisations.

What is the most famous bank failure

Here are the seven largest bank failures

| Bank name | Bank failure date | Assets* |

|---|---|---|

| Washington Mutual Bank | Sept. 25, 2008 | $307 billion |

| First Republic Bank | May 1, 2023 | $212 billion** |

| Silicon Valley Bank | March 10, 2023 | $209 billion** |

| Signature Bank | March 12, 2023 | $110 billion** |

Why are banks collapsing

Based on this array of flawed assumptions and mismanagement, each bank put billions of funds to work, some in loans and others in bonds. Most of these investments were made at lower interest rates. As inflation increased, by 2022, interest rates skyrocketed and these longer-term loans and bonds lost market value.

What are the largest bank failures

Here are the seven largest bank failures

| Bank name | Bank failure date | Assets* |

|---|---|---|

| Washington Mutual Bank | Sept. 25, 2008 | $307 billion |

| First Republic Bank | May 1, 2023 | $212 billion** |

| Silicon Valley Bank | March 10, 2023 | $209 billion** |

| Signature Bank | March 12, 2023 | $110 billion** |

What are two reasons for bank failures

For example, a bank may become insolvent if it holds nonperforming loans that cannot be paid back at their full value. A bank could also become insolvent if it holds bonds and the prices of those bonds fall because of rising market interest rates (interest rates and bond prices are inversely related).

What are the three failed banks

First Republic Bank, Silicon Valley Bank, and Signature Bank have all shut down in 2023. Here's a brief overview of why these banks failed.

What are the 3 primary risks that banks face

When handling our money, the three largest risks banks take are credit risk, market risk and operational risk.

What are 4 major risks that banks need to manage

Types of financial risks:Credit Risk. Credit risk, one of the biggest financial risks in banking, occurs when borrowers or counterparties fail to meet their obligations.Market Risk.Liquidity Risk.Model Risk.Environmental, Social and Governance (ESG) Risk.Operational Risk.Financial Crime.Supplier Risk.

What is the biggest challenge in the banking industry

1. Retaining and Recruiting Employees. Rising to number one from the second-most pressing issue at 21% going into 2022, more than one-third (34%) of bankers described retaining and recruiting employees as the biggest concern going into this year.

Which are challenges facing the banking business in India since 1991

There was extensive financial repression, reflected in detailed controls on interest rates, and large preemption of bank resources to finance the government deficit through the imposition of high statutory liquidity ratio (SLR), which prescribed investment in government securities at low interest rates.

What are the reasons for the collapse of banks

This can happen when banks have relied too heavily on short-term funding or when they have invested in illiquid assets. Solvency crisis: This type of crisis occurs when banks have negative equity, meaning that their liabilities exceed their assets, making it difficult for them to continue operating.

How safe are banks in India

Indian banks on safe ground

The RBI too has hiked policy rates steeply since May 2022, but Indian banks are not as vulnerable to market shocks from higher interest rates. Local banks deploy their assets mainly in advances, with investments comprising only a quarter of the assets.

Which is the No 1 trusted bank in India

1. State Bank of India (SBI) State Bank of India, the largest public sector no. 1 bank in India, offers a comprehensive range of banking services.

Can banks fail in India

This is not because banks don't fail, they are not immune. India's response has been to merge the failing bank with a larger bank, often a Public Sector Bank (PSB), and kick the can down the road. There is no set process, the Reserve Bank of India takes a decision based on the circumstances.

What caused banks to fail

Banks can fail for many reasons, but generally they fall into a few broad categories: a run on deposits (which leaves the bank without the cash to pay everyone who wants to withdraw their money); too many bad loans or assets that fall precipitously in value (both of which erode the bank's capital reserves); or a …

What are the 3 bank failures

Here are the seven largest bank failures

| Bank name | Bank failure date | Assets* |

|---|---|---|

| Silicon Valley Bank | March 10, 2023 | $209 billion** |

| Signature Bank | March 12, 2023 | $110 billion** |

| IndyMac Bank, F.S.B. | July 11, 2008 | $31 billion |

| Colonial Bank | Aug. 14, 2009 | $26 billion |