Can you transfer money to India from NRI account

Know the limits on transfers: While sending money to any country, one needs to be aware of remittance limits. There is no tab on the amount of money an NRI can send to India. However, the money being sent must be earned legally. Also, the sender needs to pay required taxes in the country where it has been earned.

What is the maximum amount NRI can send in India

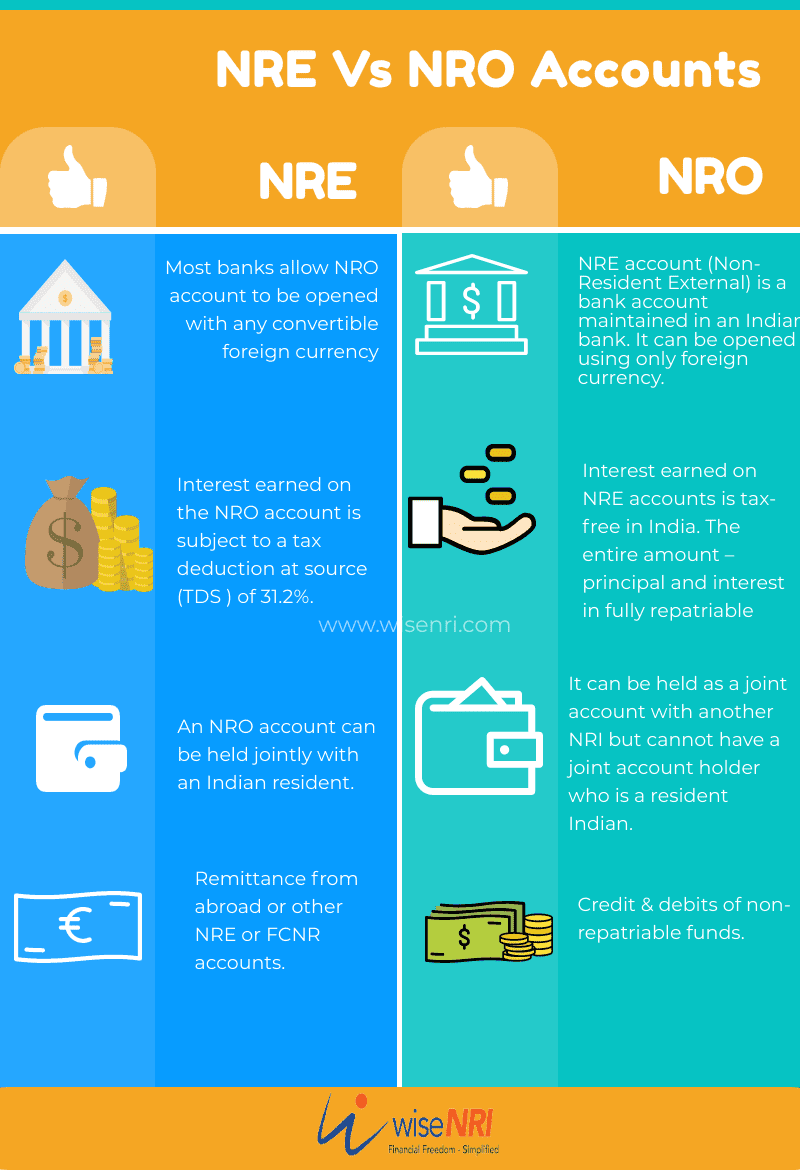

A resident individual may send up to $2.5 lakh in a year. An NRI with a Non-Resident Ordinary (NRO) account may send up to $10 lakh in a financial year. An individual with a Non-Resident External (NRE) account or a Foreign Currency Non-Resident (FCNR) Account does not have any such limits.

What is the transfer limit for NRE

The Reserve Bank of India allows the transfer of funds up to USD 1 million a year from an NRO to an NRE account.

Can you transfer money out of Vietnam

Legislation on Money Transfers Abroad

The law is very clear on this subject: if you are a Vietnamese resident and a foreigner, you have the right to take money out of the country as soon as it has been legally earned. This means that you have paid your taxes on them.

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

Is it legal to transfer money from abroad to India

RBI Rules Related to Forex Transaction

If you want to make a transaction, you must follow the rules established by the Reserve Bank of India: According to RBI regulations, remittances of up to USD 25,000 (INR 20,42,200) are allowed per calendar year.

How much money can NRI transfer to India without tax

From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability. Amount exceeding Rs700,000 is liable to TCS (Tax Collected at Source) in the hands of the individual at 5 per cent. (TCS is collected by the receiver at the time of receipt of payment.)

Can I send more than 10000 USD to India

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

Can money be transferred from NRE to normal account

Fund transfer from NRE account to other bank account is possible however IMPS is not possible from NRE to other bank NRE account.

Can we transfer funds from NRE to resident account

However, the account also provides high liquidity as it allows for easy withdrawals and deposits. It's important to note that the funds in an NRE account are fully repatriable, which means that they can be freely transferred back to the country of residence of the NRI without any restrictions.

How much money can you carry out of Vietnam

If you plan to take money out of Vietnam, you can take out amounts of less than 15 million in Vietnamese dong or USD5000 (or equivalent in other foreign currencies) without declaring this. Any amount in excess of this will need to be declared to Customs at the airport.

Is it hard to get money out of Vietnam

Transferring money out of Vietnam is not easy, but still possible. Mainly you should just expect higher fees and some hassle in the form of paperwork.

Will I be taxed if I receive money from overseas in India

Updates on foreign remittance tax India

In the 2023-23 Budget address, Finance Minister Nirmala Sitharaman announced that the Tax Collection at Source (TCS) for foreign remittances would increase from 5% to 20% of the transaction amount.

Is money received from NRI taxable in India

Any income you receive in India is taxable, with a few exceptions. You may be liable to pay taxes if you receive money from an NRI, except for marriage or inheritance reasons. Ensure you check the tax laws before you send or receive NRI gifts.

Is money received from abroad taxable in India

Updates on foreign remittance tax India

In the 2023-23 Budget address, Finance Minister Nirmala Sitharaman announced that the Tax Collection at Source (TCS) for foreign remittances would increase from 5% to 20% of the transaction amount.

How much money you can receive from abroad

Any American who receives a foreign monetary gift that exceeds $100,000 will have to report that to the IRS. There are additional reporting requirements for American expatriates and those who hold financial gifts in foreign accounts.

Do NRIs pay taxes when they transfer money to India

If you are an NRI, you also need a declaration to the effect that the total remittances being made by you have not exceeded the limit under the foreign exchange laws. As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS.

Can I transfer 100k to India from USA

The IRS has no limit on how much money you can send to India. However, above $11.7 million USD, you'll be liable for taxes.

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

Can NRI send money to wife in India

NRIs can give and receive gifts in cash or kind (jewelry, antiques, property) to and from relatives and non-relatives in India.

What happens to NRE account after returning to India

Once you come back to India permanently, you are a resident as per FEMA. And residents are not permitted to keep a NRE account. Interest on NRE FD is tax exempted only for Non-Residents. Therefore from the day you come back to India any interest earned in NRE FD becomes taxable in your hand.

Can I receive funds from NRE account

NRE Account: An NRE account is a bank account in India where NRIs can hold and manage their foreign earnings in Indian rupees. It is fully repatriable, meaning the funds can be freely transferred back to the foreign country without any restrictions.

Is money transferred to India taxable

Are inward remittances taxable in India Usually, there are no tax implications for expenses covering living costs, travel, medical bills, education, gifts, donations to charitable institutions, etc. However, it depends on the nation's laws from where you initiate the money transfer.

How many dollars can I carry from India to Vietnam

If you bring over $5,000 US Dollars, other foreign currencies of the same value (or 15,000,000 Vietnamese Dong, you're going to have to declare it at customs when you get here.

What is the best way to take out money in Vietnam

Cash withdrawal and exchange

ATMs are a common sight in Vietnamese cities, and you should have no trouble locating one in most destinations. International cards such as Visa are accepted at more than 20,000 ATMs nationwide. If you need help finding the nearest ATM, just ask your hotel.