Which bank account is better SBI or HDFC

SBI offers interest rate of 2.70% on balances less than Rs 10 crore and 3% on balances Rs 10 crore and above. HDFC Bank offers interest rate of 3% on balances less than Rs 50 lakh and 3.50% on balances of above Rs 50 lakh.

What are the disadvantages of HDFC Bank

Cons: HDFC is having limited free transactions monthly after that they will charge fee for every transaction. The customer:employee ration is low. For example you have to wait for your transaction is most of the branches.

Which account is good in HDFC Bank

| Benefits / Product | SavingsMax Account (Our Premium Product) | Senior Citizens Account |

|---|---|---|

| Why choose this product | Open a SavingsMax Account and save up to Rs 6,170 | Your priorities are ours too! Take advantage of benefits designed specially to meet your needs- from day to day banking, health and investments |

| Insurance Benefit |

How much balance should I maintain in HDFC Bank

Minimum Balance Requirements

| Balance Non-Maintenance Charges* | ||

|---|---|---|

| AMB Slabs (in Rupees) | Metro & Urban | Semi Urban |

| AMB Requirement -Rs 10,000/- | AMB Requirement –Rs. 5,000/- | |

| >=7,500 to < 10,000 | Rs. 150/- | NA |

| >=5,000 to < 7,500 | Rs. 300/- | NA |

Why SBI is better than HDFC

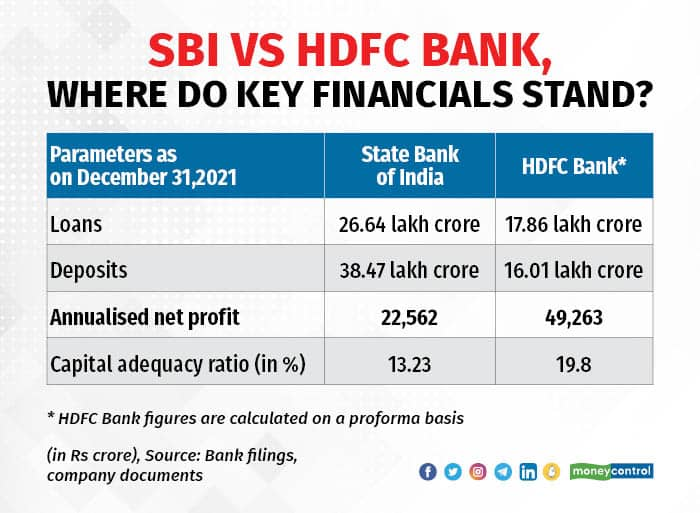

In terms of asset quality, SBI's headline numbers were higher than HDFC Bank. While SBI's gross and net non-performing asset (GNPA, NNPA) ratio stood at 4.50 per cent and 1.34 per cent as on December end, respectively, HDFC Bank's corresponding numbers stood at 1.26 per cent and 0.37 per cent for the same period.

How is HDFC performance compared to SBI

Stock performance

Shares of private lender ICICI Bank have jumped 13.4 per cent while those of state-run SBI have delivered 13 per cent return to investors in 2022 so far. HDFC Bank stock has disappointed investors, with a 4 per cent fall. In the last one month, the three lenders have fallen up to 2.6 per cent.

Which bank is safe HDFC or SBI

In terms of asset quality, SBI's headline numbers were higher than HDFC Bank. While SBI's gross and net non-performing asset (GNPA, NNPA) ratio stood at 4.50 per cent and 1.34 per cent as on December end, respectively, HDFC Bank's corresponding numbers stood at 1.26 per cent and 0.37 per cent for the same period.

Why do people prefer HDFC Bank

Quick loan disbursement

As an HDFC Bank customer, you no longer have to wait for days to get a loan sanctioned; you can avail instant loans within minutes. And this is applicable for various types of loans, from personal to two-wheeler loans, and even LOCC (Loan On credit card), without much documentation.

Why HDFC Bank is so popular

According to the study, HDFC Bank is the most profitable among all domestic scheduled commercial banks. Its return ratios, return on assets (RoA) of 1.97% and return on equity (RoE) of 16.6%, are the best, complemented by a net interest margin (NIM) of 4.2%, which is again the best among the top 10 banks.

Which bank gives 7% interest on savings account

Which bank gives 7% interest on a savings account Right now, only one financial institution is paying at least 7% APY: Landmark Credit Union. Landmark pays 7.50% on its Premium Checking Account — however, there are some major caveats to consider.

How much interest will I get for 1 lakh in HDFC Bank

The HDFC Bank FD rates for a deposit of ₹1 Lakh ranges from 3.00% p.a. to 7.25% p.a. depending on the tenor chosen. Furthermore, senior citizens also get an additional rate of 0.50% on the same.

Which is No 1 bank in India

State Bank of India (SBI)

Top 10 Banks in India 2022 vs 2023

| Rank | Bank Name | Net Profit 2023 (Rs. Cr.) |

|---|---|---|

| 1 | State Bank of India (SBI) | 56,558 |

| 2 | HDFC Bank | 46,149 |

| 3 | ICICI Bank | 34,463 |

| 4 | Punjab National Bank (PNB) | 3,069 |

Which bank is more trusted in India

State Bank of India

State Bank of India is India's largest and most trusted commercial bank. It is among the oldest banking institutions in the country and is headquartered in Mumbai, Maharashtra. No doubt, it is one of the Top 10 Banks in India in 2023.

Which is the No 1 trusted bank in India

1. State Bank of India (SBI) State Bank of India, the largest public sector no. 1 bank in India, offers a comprehensive range of banking services.

Which is the No 1 bank in India

1. State Bank of India. State Bank of India (SBI) is among the Fortune 500 companies. It is an Indian multinational and Public Sector Banking and Financial services firm.

Is HDFC Bank good for long term

"Investors often focus on midcap and smallcap stocks for big returns but sometimes even largecap stocks can deliver surprisingly high returns… HDFC Bank is one such stock. It can give a 2x return in comparison to FDs," said the market wizard.

Who is the No 1 bank in India

State Bank of India (SBI)

Top 10 Banks in India 2022 vs 2023

| Rank | Bank Name | Net Profit 2023 (Rs. Cr.) |

|---|---|---|

| 1 | State Bank of India (SBI) | 56,558 |

| 2 | HDFC Bank | 46,149 |

| 3 | ICICI Bank | 34,463 |

| 4 | Punjab National Bank (PNB) | 3,069 |

Where is HDFC ranked in India

Top ten Indian banks (in terms of market capitalisation)

| Rank | Bank | Mcap ( ₹crore) |

|---|---|---|

| 1. | HDFC Bank (post merger) | 14,12,055.5 |

| 2. | ICICI Bank Ltd | 6,53,704.04 |

| 3. | State Bank of India | 5,11,201.77 |

| 4. | Kotak Mahindra Bank Ltd | 3,66,967.55 |

Where can I get 5% interest on my savings account

Best 5% Interest Savings AccountsWestern Alliance: 5.15% APY.OceanFirst Bank: 5.17% APY.Mission Valley Bank: 5.12% APY.CloudBank 24/7: 5.20% APY.M1 High-Yield Savings Account: up to 5.00% APY.Newtek Bank Personal High-Yield Savings Account: 5.00% APY.Valley Direct: 5.00% APY.Adda Bank: 4.85% APY.

What bank pays highest interest

Best High-Yield Savings Account RatesCFG Bank – 5.17% APY.Western State Bank – 5.15% APY.TotalDirectBank – 5.07% APY.Popular Direct – 5.05% APY.Vio Bank – 5.02% APY.Salem Five Direct – 5.01% APY.Dollar Savings Direct – 5.00% APY.Newtek Bank – 5.00% APY.

Which bank gives highest interest

| Bank | Interest rate | Tenure |

|---|---|---|

| Unity Small Finance Bank | 9% | 1001 days |

| Shivalik Small Finance Bank | 8% | 18 Months to less than 24 months. |

| Suryoday Small Finance Bank | 8.51% | 999 days |

| Fincare Small Finance Bank | 8.41% | 1000 days |

Which bank has highest FD interest rates

Canara Bank offers the highest interest rate of 7.25% on tenure of 444 days for general citizens. The rates are applicable from April 5, 2023. Yes Bank offers 7.50% interest rate on fixed deposits with tenure of 1 Year to less than 18 months. The rates are effective from May 2, 2023.

Which bank is very safe in India

Top Banks for FDs in India

| Sr No | List Of Banks | Score |

|---|---|---|

| 1. | State Bank of India | AAA |

| 2. | HDFC Bank | AAA |

| 3. | Bank of Baroda | AAA |

| 4, | ICICI Bank | AAA |

Which is the top 2 bank in India

Top 10 Banks in India HDFC Bank (post-merger) 14,12,055.5. ICICI Bank Ltd 6,53,704.04. State Bank of India 5,11,201.77. Kotak Mahindra Bank Ltd 3,66,967.55. Axis Bank Ltd 3,04,211.88. Indusind Bank Ltd 1,06,707.03. Bank of Baroda 98,436.88. IDBI Bank Ltd 59,482.29.

Is it safe to keep money in SBI

How is SBI bank safe Your assets are entirely under the bank's control. SBI offers its clients compensation in the event that a bank-related disaster occurs. Your data is protected by a 128-bit SSL encryption mechanism at SBI.