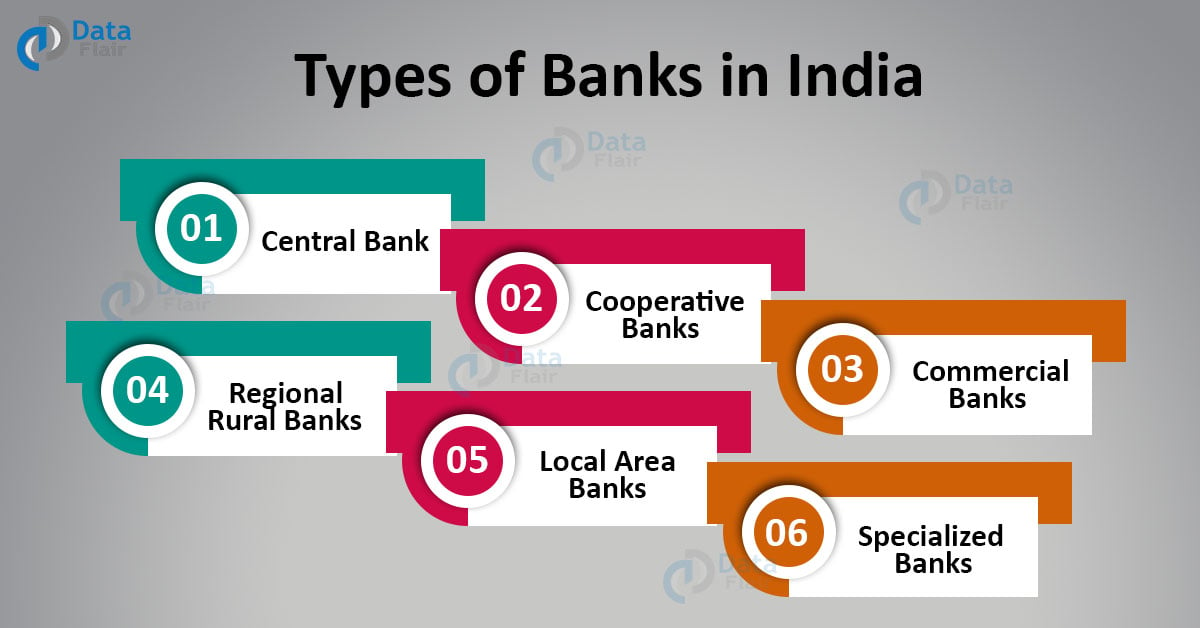

What are the 4 types of banks

The 4 different types of banks are Central Bank, Commercial Bank, Cooperative Banks, Regional Rural Banks. You can read about the Types of Banks in India – Category and Functions of Banks in India in the given link.

How Indian banks are classified

Indian Banks are broadly classified into two types – scheduled and non-scheduled. These banks could be commercial, small finance, payments and cooperative banks. Private, public, foreign and regional rural are common types of commercial banks.

What are different types of banks

Daily Current AffairsCentral Bank.Cooperative Banks.Commercial Banks.Regional Rural Banks (RRB)Local Area Banks (LAB)Specialized Banks.Small Finance Banks.Payments Banks.

How many types of banks are there in India name them

Scheduled and non-scheduled banks, commercial banks, public sector banks, private sector banks, foreign banks, payments banks, small finance banks, etc., are the different types of banks in India.

What is a Category 4 bank

(1) A banking organization with average total consolidated assets of $100 billion or more is a Category IV banking organization if the banking organization: (i) Is not a Category II banking organization; and. (ii) Is not a Category III banking organization.

Which are the 4 big banks

What are the Big Four Banks The term 'Big Four Banks' alludes to the Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), Australia and New Zealand Banking Group – or ANZ Bank for short – (ASX:ANZ) and National Australia Bank (ASX:NAB).

What are the 2 most popular types of banks

The two most popular are banks and credit unions, but there are actually many more specific types within the various categories listed by the Federal Financial Institutions Examination Council.

How many categories are there in a bank

What are the different bank types There are Retail banks, Commercial banks, Investment banks, Credit unions, Private banks, Savings and Loan Associations, Challenger banks, and Neobanks.

What is the most common type of bank

The most common financial institution the public uses is commercial banks. It is because commercial banks offer lower service fees that enable clients to keep their accounts open without worrying about them being closed. Their services are not limited as they offer plenty of products to their clients.

What are the names of the 3 types of banks

There are three major types of depository institutions in the United States. They are commercial banks, thrifts (which include savings and loan associations and savings banks) and credit unions.

How many banking systems are in India

The banking system of India consists of the central bank (Reserve Bank of India – RBI), commercial banks, cooperative banks and development banks (development finance institutions).

What are the 14 major Indian banks

The 14 private banks which were nationalized in 1969 are Allahabad Bank, UCO Bank, Canara Bank, United Bank of India, Central Bank of India, Syndicate Bank, Indian Overseas Bank, Bank of Baroda, Punjab National Bank, Dena Bank, Bank of India, Bank of Maharashtra, Indian Bank, and Union Bank.

What is D1 D2 D3 d4 in banking

(D1 = doubtful up to 1 year, D2= doubtful 1 to 3 years, and D3= doubtful more than 3 years). For commercial banks 100 percent of the extent to which the advance is not covered by the realisable value of the security to which the bank has a valid recourse and the realisable value is estimated on a realistic basis.

What is Category 1 bank

Authorized dealer Category 1 Banks, popularly known as AD Cat I Banks, are the banks with an RBI license to buy and sell foreign exchange for specified purposes. Such banks aim to ease the foreign exchange facilities for NRI.

What is a top 4 bank

The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These banks are not only the largest in the United States, but also rank among the top banks worldwide by market capitalization, with JPMorgan Chase being the most valuable bank in the world.

What are the 4 money center banks

Four examples of large money center banks in the United States include Bank of America, Citi, JP Morgan, and Wells Fargo, among others. Most money center banks raise funds from domestic and international money marks (as opposed to relying on depositors, like traditional banks).

What are the 3 most popular banks

JPMorgan Chase – $3.31 Trillion.Bank of America – $2.41 Trillion.Citigroup – $1.714 Trillion.Wells Fargo & Co. – $1.712 Trillion.U.S. Bancorp – $591.21 Billion.PNC Financial Services – $553.39 Billion.Truist Financial Corporation – $534.19 Billion.Goldman Sachs – $513.91 Billion.

What is a Category 5 bank

Category 5: small market participants. Low risk.

What are the big 3 core banking

This aggressive move is particularly remarkable considering that Jack Henry, together with FIS and Fiserv — the other two members of the Big Three bank technology companies — provides the processing power for most of the U.S. banking industry and a large portion of credit unions.

Which banking is popular in India

Summary: 10 Best Banks in India 2023

| Company | Industry | Market Cap (Rs. Cr.) |

|---|---|---|

| State Bank of India (SBI) | Banking | 505,579 |

| HDFC Bank | Banking | 884,252 |

| ICICI Bank | Banking | 648,053 |

| Punjab National Bank (PNB) | Banking | 55,495 |

Who is the No 1 bank in India

State Bank of India (SBI)

Top 10 Banks in India 2022 vs 2023

| Rank | Bank Name | Net Profit 2023 (Rs. Cr.) |

|---|---|---|

| 1 | State Bank of India (SBI) | 56,558 |

| 2 | HDFC Bank | 46,149 |

| 3 | ICICI Bank | 34,463 |

| 4 | Punjab National Bank (PNB) | 3,069 |

Which is the top 10 bank in India

Based on the extent of their network and financial revenue, the Top 10 Banks in India are Axis Bank Ltd., Bank Of Baroda, Bank of India, IndusInd Bank Ltd., Punjab National Bank, Kotak Mahindra Bank Ltd., State Bank of India, ICICI Bank Ltd., Yes Bank Ltd., and HDFC Bank Ltd.

What does D3 D2 and D1 mean

What do D1, D2, and D3 mean D1, D2, and D3 stand for Divisions 1, 2, and 3, which are athletics leagues run by the National Collegiate Athletic Association, or NCAA. These are the leagues that most colleges in the United States compete in.

What is D1 D2 D3 in banking

(D1 = doubtful up to 1 year, D2= doubtful 1 to 3 years, and D3= doubtful more than 3 years). Loss assets should be written off.

What are Category 3 banks

Category III: applies to organizations to which categories I-II do not apply and that have more than $250 billion in total consolidated assets or more than $75 billion in one of the following three categories: weighted short-term wholesale funding, nonbank assets, and off-balance sheet exposure.