What are the benefits of international bank account

What are the benefits of offshore bankingpotentially tax-efficient savings and investments in various currencies, although any tax benefits would depend on your circumstances.hold money, make and receive payments in multiple currencies.manage foreign exchange.access international expertise and investment advice.

Can I have bank accounts in different countries

Opening a foreign bank account might seem intimidating, but it's entirely doable and could be beneficial to you and your finances. If you are working or living abroad for even just part of the year, having a bank account located in your foreign residence would make depositing, withdrawing and transferring money easier.

What should I keep in mind when opening a bank account

Things to consider while opening a Savings AccountInterest rate.Average minimum balance guideline.Availability of 24×7 banking facility.The network of banking branches.The availability of credit facilities.Offers and discounts provided by the bank.Charges and fees that you need to pay.

How many types of bank accounts are there

These bank accounts included Current, Savings, Fixed Deposit, and Recurring Deposit Accounts. However, with the banking sector advancements, there are other forms of bank accounts that were introduced. These new bank accounts are DEMAT and NRI Account.

Is it smart to have an overseas bank account

Having an offshore bank can be necessary if you run a business in a foreign country or if you live in another country for part of the year. You may also choose to use offshore banking in a country that has favorable tax treatment.

Should I open an international bank account

If you have reasons to open an overseas bank account, such as you're planning to move abroad, you regularly travel between countries for business or you're supporting a family member in a foreign country, then opening an overseas bank account can make sense.

Can an Indian have a bank account in a foreign country

Yes. RBI permits Indians to open and maintain a bank account overseas. Under the Liberalized Remittance Scheme of the RBI, sending money to your account overseas is a legitimate purpose. RBI revised the LRS purpose code S0023 to 'Opening of foreign currency account abroad with a bank' in Feb 2016.

How can I open international bank account in India

Things to knowyour employment, income and tax details.proof of ID, like your passport, driving license or national ID.proof of address, like a bank statement or utility bill.additional documents, subject to qualification status, local laws and regulations.

How much money can you put in a bank without questions

The IRS requires banks and businesses to file Form 8300, the Currency Transaction Report, if they receive cash payments over $10,000. Depositing more than $10,000 will not result in immediate questioning from authorities, however. The report is done simply to help prevent fraud and money laundering.

What are 3 questions you should ask when opening a bank account

10 questions to ask about your checking accountDoes the bank have online banking and a mobile appWhere are the bank's branchesWhat are the bank's feesWhat are the minimum balance requirementsCan I use an ATM for freeWhat happens if I try to withdraw more money than I have in my account

What is an NRI account in India

An NRI Account refers to the accounts opened by a Non-Resident Indian (NRI) or a Person of Indian Origin (PIO) with a bank or financial institution which is authorised by the Reserve Bank of India (RBI), to provide various services.

How many bank accounts can a person have in India

While there's no limit to how many Savings Accounts you can have, there are a few things to consider before signing up for more than one. According to financial experts, it isn't advisable to open more than three Savings Accounts, as it can be difficult to manage.

How much money can I have in a foreign bank account

$10,000

U.S. persons (U.S. citizens, Green Card holders, resident aliens, and dual citizens) are required to file an FBAR if the combined balance of all the foreign accounts you own or have a financial interest or signature authority is more than $10,000 at any point during the calendar year.

What is the downside of international transfers with your bank

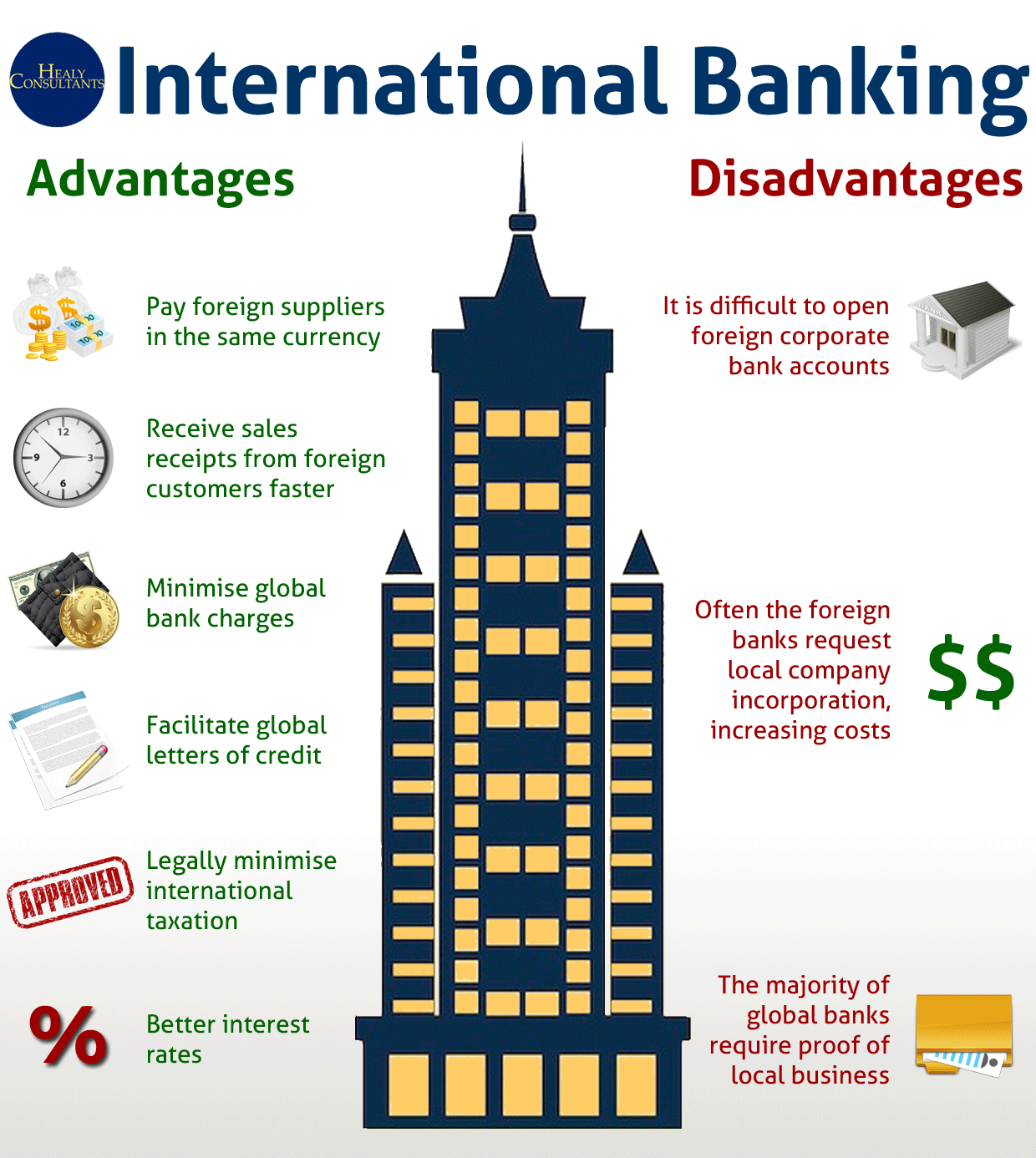

Cons of bank transfers

Banks usually charge fees for sending or receiving money, especially for international transfers. The fees may vary depending on the amount, the destination, the method, and the service provider. You may also incur additional fees from intermediary banks or currency conversion rates.

What happens if I have more than $10000 in a foreign bank account

U.S. persons (U.S. citizens, Green Card holders, resident aliens, and dual citizens) are required to file an FBAR if the combined balance of all the foreign accounts you own or have a financial interest or signature authority is more than $10,000 at any point during the calendar year.

What is the disadvantage of international bank

Costlier than domestic checking accounts: Foreign bank accounts cost more than local ones. Offshore financial services firms know their clients are wealthy, so they charge large fees.

Do I have to report my foreign bank account in India

Each and every foreign bank account, investment, or other types of assets must feature on your ITR. The only individuals who escape this requirement are Non-Resident Indians (NRIs) or residents not ordinarily resident in India.

What are the rules for foreign banks in India

What are Foreign BanksBanks must adhere to the Basel Standard's mandated Capital Adequacy requirements.They must meet the INR 500 crore minimum capital requirement.They should keep the CRAR at a minimum of 10%.Foreign banks' priority sector targets in India are 40%.

Which NRI account is best in India

Best NRE Savings Account for NRIs in 2023

| Name of the Bank | NRE Deposit Interest rates below Rs. 2 crores | |

|---|---|---|

| Bank of Baroda | 4.90% | 5.25% |

| Bank of India | 5.25% | 5.30% |

| Canara Bank | 5.25% | 5.50% |

| Citibank | 2.75% | 3.50% |

What happens if you transfer more than $10000

Financial institutions must file a Currency Transaction Report (CTR) for any transaction over $10,000. The CTR includes information about the person initiating the transaction, the recipient, and the nature of the transaction.

What to do when you have $10,000 in the bank

Here are six things you should do if you have over $10,000 in your savings account.Pay Off Debt. One of the first things you should do if you have over $10,000 in your savings account is pay off outstanding debt.Keep Some Liquid.Invest.Move to a High-Yield Savings Account.Split the Funds.Give Your Kids a Head Start.

What are four things you should consider when choosing a bank

Here's what you need to consider when choosing a bank.Security. Whether you choose to put your money in an online bank vs.Bank Fees. This is an important factor.Interest Rates.Location.Ease of Deposit.Digital Banking.Minimum Requirements.Availability of Funds.

Does NRI account need to pay tax in India

An NRI's income taxes in India will depend upon his residential status for the year as per the income tax rules mentioned above. If your status is 'resident', your global income is taxable in India. If your status is 'NRI,' your income earned or accrued in India is taxable in India.

What is difference between NRI and NRE account India

1. Definition. NRE stands for Non-Resident External and you can use it to deposit funds that you earn abroad in a foreign currency. In contrast, you can use a Non-Resident Indian (NRI) account to manage income and funds that are generated in India in Indian rupees.

What is the maximum amount of money you can have in a bank account India without tax

The annual limit of depositing cash in a savings account is not more than INR 10 lakhs in a financial year. So, unless you don't cross that limit you will not be scanned by the IT Department. In case an amount of more than 2.5 lakhs is deposited and is not shown in the ITR.