Can I transfer money from my Indian account to international account

Transferring money to an international bank account

The Reserve Bank of India (RBI) allows Indian citizens to make international remittances of up to USD250,000 per financial year through the Liberalised Remittance Scheme. You can send money overseas via a: bank. post office.

Can I transfer money from savings account to abroad

There are several methods to send money abroad from your Indian savings account. The most popular options are wire transfers, online remittance services, and foreign currency demand drafts. Wire Transfer: A wire transfer, also known as a SWIFT transfer, is a secure and quick method to transfer funds internationally.

Can I transfer my savings from India to UK

You can make a bank transfer directly from your Indian bank account to your chosen UK account. If your bank is international and has a bank branch in both India and the UK, you may be able to save money by using an “interbank” transfer.

Can you move money out of India

Any transfers for sending money out of India do need to comply with the Reserve Bank of India's Liberalised Remittance Scheme. This means that the total amount of transfers in a financial year can not exceed the currency equivalent of $250,000 USD.

How much money can NRI transfer from India to abroad

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Do I need to pay taxes on foreign money transferred to my account in India

Are inward remittances taxable in India Usually, there are no tax implications for expenses covering living costs, travel, medical bills, education, gifts, donations to charitable institutions, etc. However, it depends on the nation's laws from where you initiate the money transfer.

How much money can an NRI transfer out of India

How much money can an NRI repatriate out of India An NRI can freely transfer without any upper transaction limit from NRE and FCNR accounts. On the other hand, an NRI can remit only up to 1 USD million out of the balances of an NRO account, provided they meet the eligibility criteria. 2.

Do I need to pay tax if I transfer money from India

The Budget proposes that any outward remittances for purposes other than medical treatment and education will incur a tax collected at source (TCS) of 20% on the entire value. Presently, TCS of 5% is applicable on certain foreign outward remittances exceeding Rs. 7 lakh in a year.

How much money can you transfer without paying taxes in India

An amount over Rs 50,000 per year is subject to taxation in the hands of the receiver.

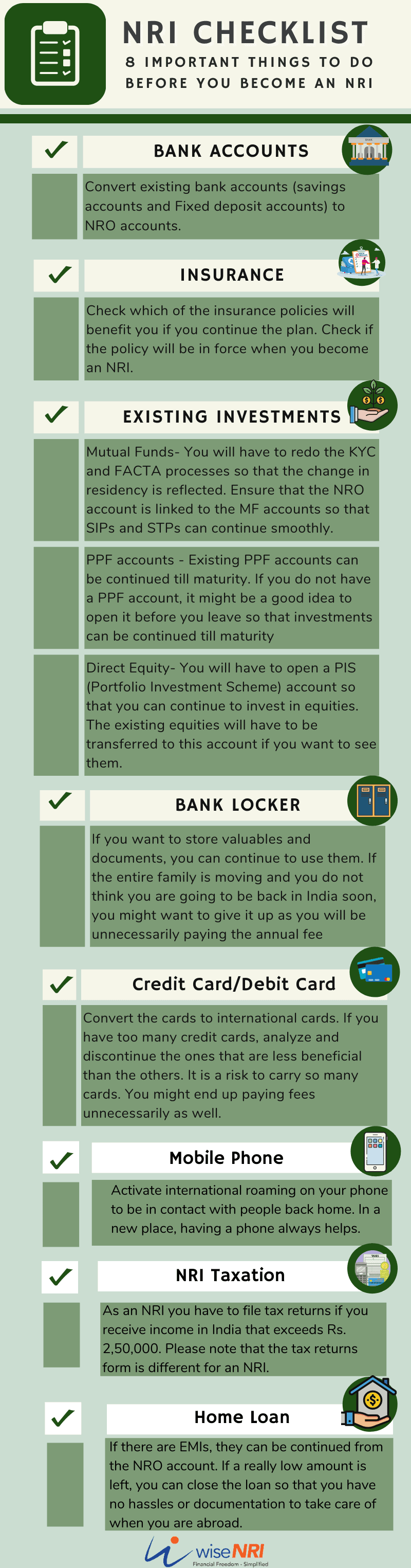

What happens to my Indian investments if I move abroad

INVESTMENTS. If you wish to continue holding your equity portfolio, your demat account will have to be redesignated as an NRO or NRE (non-resident external) account. “If you are making any fresh investments in the country of residence, the earning will be sent to India via the NRE account.

How much Indian cash can an Indian citizen carry abroad

Exporting Indian rupees is strictly prohibited for non-Indian residents. Residents of India can travel abroad with up to Rs. 25,000¹. There's no limit to how much of a foreign currency you can take out of India.

Can NRI take money out of India

NRIs live abroad and earn money abroad but many of them have money in India through passive earning such as rent or through the sale of investments and property. It is possible for them to transfer these funds outside India provided they follow the regulations laid down by RBI.

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

Does NRI account need to pay tax in India

An NRI's income taxes in India will depend upon his residential status for the year as per the income tax rules mentioned above. If your status is 'resident', your global income is taxable in India. If your status is 'NRI,' your income earned or accrued in India is taxable in India.

How much money can NRI transfer to India without tax

From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability. Amount exceeding Rs700,000 is liable to TCS (Tax Collected at Source) in the hands of the individual at 5 per cent. (TCS is collected by the receiver at the time of receipt of payment.)

How much money can be transferred to NRE account from abroad

The Reserve Bank of India allows the transfer of funds up to USD 1 million a year from an NRO to an NRE account. Here is a list of documents you will require if you are planning transfer funds from an NRO account to an NRE account, according to the IDFC FIRST Bank. Form 15CB – It is a form certified by the CA.

Do I have to pay tax on money transferred from India to overseas

Taxation of India's Outbound Remittances: LRS Scheme and Increased Tax Rate from October 1. Effective from October 1, 2023, the tax rate on outbound remittances from India will rise from five percent to 20 percent. This increase will impact funds sent abroad for purposes such as vacations, investments, and gifts.

How much money can I transfer without being flagged India

The income tax department will be looking at high-value transactions, i.e., transactions above Rs 2.5 lakh by an individual, and may investigate these. The taxmen or bank officials may question anyone receiving high-value funds in his account, even if it is through an electronic transaction.

Can I keep NRI account after returning to India

Once you come back to India permanently, you are a resident as per FEMA. And residents are not permitted to keep a NRE account. Interest on NRE FD is tax exempted only for Non-Residents. Therefore from the day you come back to India any interest earned in NRE FD becomes taxable in your hand.

Do I need to close bank account before leaving India

Residents who leave India with the intention of staying abroad for an extended period of time must intimate their bank of their intention and then the bank will convert their resident bank accounts to foreign currency accounts.

How much foreign currency can an Indian keep

The RBI also allows the residents of India to retain foreign exchange up to US $2,000 in the form of currency notes or coins. Otherwise, you must surrender the rest to the bank within 90-180 days of return.

How many Singapore dollars can I carry from India

On foreign currency, including Singapore Dollars, there is no cash limit, provided it has been obtained from authorized money exchange, and the traveler has receipt of the transaction.

Is it illegal for NRI to have savings account in India

As per the Foreign Exchange Management Act (FEMA) guidelines, an NRI cannot have a savings account in his or her name in India. You must convert all your savings (money earned abroad) to a Non-Resident External Account (NRE) or Non-Resident Ordinary (NRO) account.

Do I have to pay tax on money transfer from India to overseas

Effective from October 1, 2023, the tax rate on outbound remittances from India will rise from five percent to 20 percent. This increase will impact funds sent abroad for purposes such as vacations, investments, and gifts.

What are the tax rules for NRI returning to India

Even the FCNR and NRE accounts of such RNORs are tax-free. The assets and money brought to India by such NRIs are exempt from any wealth tax for up to 7 assessment years. Under FEMA, NRIs who return to India can own, hold, invest, or transfer their assets not located in India.