What is the swift code of Icici Bank for inward remittance

ICICINBBNRI

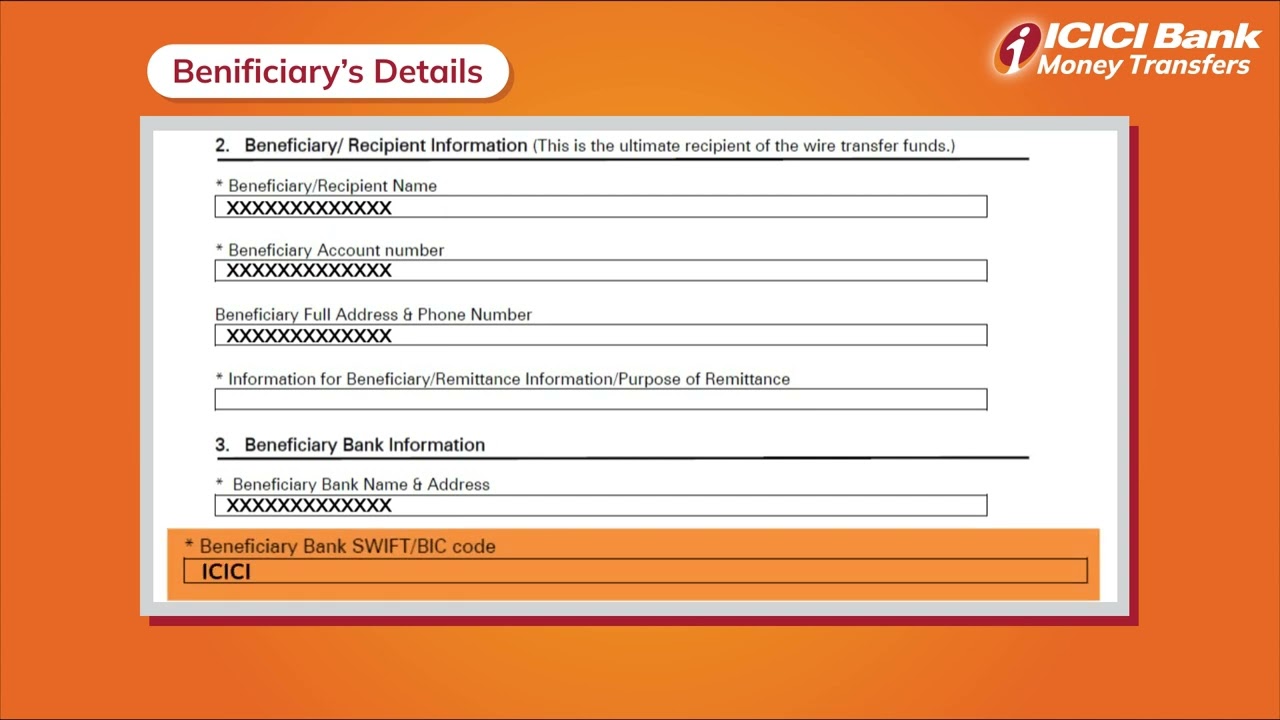

Ensure that your local bank mentions your account number, name address and purpose of remittance in the payment message to avoid any delay in processing your transaction. 2. Swift / BIC Code for ICICI Bank for retail remittances is: ICICINBBNRI.

Which scheme for forex remittances is recently launched by Icici Bank

ICICI Bank: Users of 'Money2World' can remit funds to 21 currencies for a host of purposes including education, maintenance of close relatives, gift and travel.

Which bank gives best rate for inward remittance

Which bank is best for international transfers

| Provider | International transfer fee |

|---|---|

| Wise International Transfers | 230.24 INR |

| ICICI International Transfers | 750 INR + correspondent fees |

| HDFC International Transfers | 500 INR transfer fee + 500 INR SWIFT fee |

| PNB International Transfers | 500 INR transfer fee + correspondent fees |

Do you need SWIFT code to receive international transfer

Your full account number. For domestic wires, your routing number. For international wires, they need to use a Swift Code instead of the routing number.

Is SWIFT code same for all Icici banks

Each ICICI Bank branch has a unique SWIFT code. You can check the correct SWIFT codes for your ICICI Bank branch here. However, if you're not sure, or can't find the branch code, you can use the 8 character head office SWIFT code, and your payment will still make its way to your account.

How much does Icici charge for foreign remittance

The charges for online outward remittance from NRO Savings Account to an Overseas Account is INR <500> plus applicable Goods and Services Tax (GST). There are no charges for online outward remittance from NRO Savings Account to an NRE Account with ICICI Bank.

How much time it takes for foreign remittance in Icici Bank

It enables you to transfer funds from your account to Beneficiary account across the globe. Credit to the beneficiary's account in 1-3 working days*.

Can I receive money from abroad in my bank account

You can receive money from abroad via a bank transfer directly from the sender's bank account into yours. To receive a bank transfer from abroad, you'll need to provide the sender with your: Bank details. Full name.

How can I receive payments from abroad in India

Wire TransferRecipient's details – name, address and bank account number.IFSC code of the recipient bank.SWIFT (Society for Worldwide Interbank Financial Telecommunication) /BIC (Business Identifier Code) number of sender and receiver bank.

Can banks transfer money without SWIFT

The Swift code is similar to the IFSC code, which is used for domestic interbank transactions, whereas the IFSC code is used for international transfers. If someone wishes to send money overseas from India, for example, they'll need the latter's bank account number as well as the destination bank's Swift code.

Can I receive an international wire transfer

Money and support can come from virtually anywhere. Whether you have family abroad or friends, the process for receiving an international wire transfer is typically the same as a domestic one. You just need to give the sender a few more details than usual.

What is the SWIFT code of Icici Bank for receiving money from abroad

ICICINBBNRI

Swift / BIC Code for ICICI Bank for retail remittances is: ICICINBBNRI. * This currency will be received in equivalent USD.

Does it matter which SWIFT code I use

This varies by bank. Some banks use the same SWIFT code for all their branches while other banks designate a unique SWIFT code for each branch. If you are unsure of which code to use, you can typically use the bank's head office SWIFT code to send money.

Is there a fee to receive money from overseas

Most of the fees associated with an international money transfer are paid by the sender. However, as a recipient, you may have to pay a receiving fee and intermediary fee. The actual amount you receive in your account will depend on the exchange rate and the fees charged on both ends of the transaction.

What is the limit of Icici overseas transfer

Limit of USD 2,50,000* or its equivalent per financial year is applicable for the below mentioned purposes of travel.

What is the foreign transaction fee for Icici Bank

3.5%

The forex markup fees charged by almost all ICICI Bank credit cards is 3.5% of the total transaction amount.

Can I receive money from abroad in my bank account in India

With a multi-currency account, individuals and companies can receive payments from abroad in several currencies without incorporating their business abroad. Normal bank accounts may be unaffordable for SMEs and startups due to their high fees and tedious money transfer periods.

How can I receive money from other country to India

Sign up for a free Wise account now and save money while growing your digital business.PayPal. PayPal has long been in the global money transfers market.Instamojo.Xoom.SBI.HDFC bank.ICICI bank.Axis bank.

Can I receive money directly to my account from abroad

You can receive money from overseas directly into your bank account, using an international money transfer service. You'll need to provide your bank details so the sender can set up an online account with the international money transfer provider and exchange the money into your desired currency.

How do I receive international payments to my bank account

If you want to receive money from overseas and have it deposited into your local INR account you can also do this through an international money transfer specialist. In this case you'll just give the sender your INR bank details and they'll arrange the payment via the specialist service you select.

Do I need a SWIFT code to receive money

Your SWIFT code is usually required if someone is sending you an international money transfer as it's used to identify an individual bank to verify international payments. For example, a company might ask for your SWIFT code if they're paying your invoice via overseas transfer.

Is SWIFT code enough to receive money

Do I need a SWIFT or BIC code to make an international payment Wherever you are in the world, if you need to send or receive funds overseas through your bank, the SWIFT code of the recipient is usually required. Without this code, the transaction will likely not go through.

Which bank accept international wire transfer

Which bank is best for international wire transfers

| Provider | Fee for $1000 to Germany | Exchange rate |

|---|---|---|

| Bank of America² | $45 | exchange rate + likely markup |

| BECU³ | $35 | exchange rate + likely markup |

| Capital One⁴ | $50 | exchange rate + likely markup |

| Chase Bank⁵ | $50 with assistance from Chase, or $40 online | exchange rate + likely markup |

How much international wire transfer can I receive

Is There A Wire Transfer Limit The IRS does not impose any transfer limits on international transfers but there are reporting requirements for transfers of $10,000 or more and for individual payments made over a short period of time that add up to exceed $10,000.

Do I need a SWIFT code to receive money from overseas

Yes, you will need a SWIFT code to make an international money transfer. This code helps ensure your money transfer arrives at the intended location.