Which income is taxable in India to non-resident individual

An NRI's income taxes in India will depend upon his residential status for the year as per the income tax rules mentioned above. If your status is 'resident', your global income is taxable in India. If your status is 'NRI,' your income earned or accrued in India is taxable in India.

Is my foreign income taxable in India

income tax in India. The foreign income i.e. income accruing or arising outside India in any financial year is liable to income-tax in that year even if it is not received or brought into India. There is no escape from liability to income-tax even if the remittance of income is restricted by the foreign country.

How will the income of a non-resident foreign company be taxed in India

Only the income attributed to India will be taxed in India. As it is a non-resident company, they will be subject to an income tax levied at 40%. Foreign Companies with a PE will have to also pay minimum alternate tax at 15%, under the IT Act.

How to show foreign income in India

If the income is a payment for your services rendered abroad, include it under 'Income from salary. Always select relevant income head based on the nature of income and list the foreign income under that particular head. 👉 After clubbing the foreign income, it would be a part of your income earned in India.

Do NRI need to declare foreign income in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

What is the non resident rule in India

The NRI status in India is attained by people who are Indian citizens but stay in India for less than 182 days in the preceding financial year or people who live outside India for employment, business, or any other purpose for an uncertain period.

Do I need to pay tax in India if I work in Dubai

As an NRIs in UAE, you are exempted from paying income tax in UAE. You do not have to pay any tased on your UAE Income in India too, under the UAE-India Double Taxation Avoidance Agreement. However, you must pay taxes on any income earned form investments in India.

Do foreign investors pay taxes in India

Section 115AD of the Income Tax Act, 1961, deals with Tax on income of Foreign Institutional Investors from securities [excluding income from units of mutual fund which are taxed u/s 115AB] or capital gains arising from the transfer of such securities.

Can a foreign national start a business in India without being a resident

Ans: No a foreigner or a non-resident Indian would not need Residency visa for starting a company in India. However following are the documents that would be required in case of foreign national to become a director in India.

Should NRI file income tax return in India

NRIs have to pay income tax on income earned in India. NRIs have to pay tax on income that accrues or arises in India. NRIs also need to pay tax on income which is deemed to accrue or arise in India. Money received or deemed to be received in India is taxable.

Do I have to report foreign income

In general, yes — Americans must pay U.S. taxes on foreign income. The U.S. is one of only two countries in the world where taxes are based on citizenship, not place of residency. If you're considered a U.S. citizen or U.S. permanent resident, you pay income tax regardless where the income was earned.

How much money NRI can send to India without tax

As an NRI, there will be no tax applicable on your remittance since the remittance is not being made under LRS. How is tax cut currently on remittances and since when did it apply From October 1, 2020, remittances of up to Rs700,000 (Dh33,103) in a financial year are free from tax liability.

Can NRI bring money to India

There is no tab on the amount of money an NRI can send to India. However, the money being sent must be earned legally. Also, the sender needs to pay required taxes in the country where it has been earned. While sending money from the United States, there is a limit of USD $14,000 per person per year.

Should NRI pay tax in India

NRIs are required to file a return of income if they have taxable income in India. In the following situations, an NRI is required to file Income Tax Return in India: If your Gross Total Income before allowing any deductions under section 80 is more than Rs. 2,50,000.

Does NRI need to file tax in India

NRIs have to pay income tax on income earned in India. NRIs have to pay tax on income that accrues or arises in India. NRIs also need to pay tax on income which is deemed to accrue or arise in India. Money received or deemed to be received in India is taxable.

Does NRI pay tax in India

By default, income earned by an NRI abroad is not taxable in India. But if the income in India through aspects like capital gains from investments in shares, mutual funds, property rental and term deposits exceed the basic exemption limit as defined in the Income Tax Act, an NRI would have to file a tax return.

How can NRI save tax in India

Tax Exemptions for NRIsThe interest earned on FCNR/NRE accounts.Interest earned on notified bond and government-issued savings certificates.Dividends earned from shares of domestic Indian companies.Long term capital gains from equity-oriented mutual funds and listed equity shares.

How much tax on forex income in India

Taxation Rates: If forex trading income is considered business income, it is taxed at the individual's applicable income tax slab rates, which vary based on the total income earned. The rates can range from 5% to 30% plus applicable surcharges and cess.

Can I do business in India as an NRI

NRIs have the option of forming a Private Limited Company, a Limited Liability Partnership or open a branch office, liaison office, or project office in India. The most preferred form of business organizations for foreign investors is Private Limited Company and LLP.

Can an NRI set up a company in India

One of the key prerequisites to incorporate an OPC, was to be a resident of India. Thankfully, The Companies (Incorporation) Second Amendment Rules, 2021 lifted that prerequisite and has allowed NRIs to establish OPCs in India.

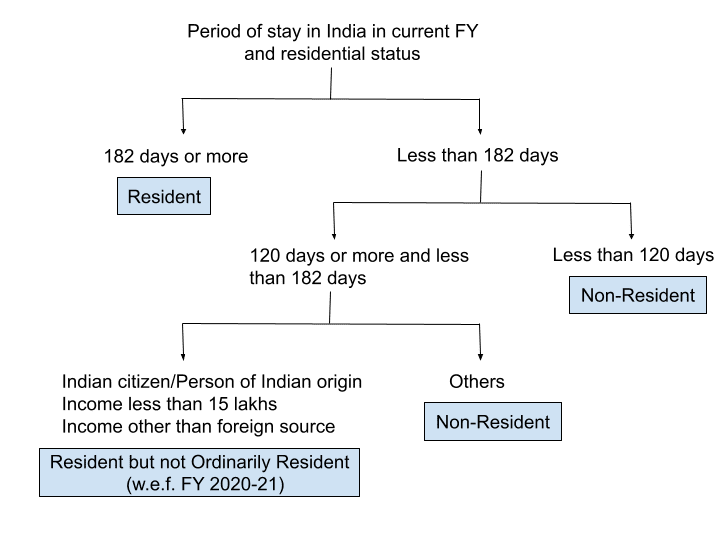

What are the new tax rules for NRI in India

New Rules to Determine NRI Status

You should be physically present in India for 182 days or more during the relevant financial year. Or. Your physical presence in India during the applicable financial year is 60 days or more and 365 days or more in the preceding four financial years.

Do non resident aliens have to report foreign income

Unlike resident aliens, nonresident aliens are required to pay income tax only on income that is earned in the U.S. or earned from a U.S. source. 6 They do not have to pay any taxes on foreign-earned income.

How do I report foreign income to IRS

If you earned foreign income, you would need to report it on Form 1040 when filing your tax return. You may also need to file other tax forms depending on what type of income you earned.

How much money can NRI transfer to India in one year

As of the financial year 2021-2022, the LRS limit for NRIs is INR 2,50,00,000 per financial year. This limit applies to the total amount of funds transferred by an NRI during the financial year, and includes all transfers made for any purpose, including investments, gifts, and personal expenses.

Is money received from NRI taxable in India

Any income you receive in India is taxable, with a few exceptions. You may be liable to pay taxes if you receive money from an NRI, except for marriage or inheritance reasons. Ensure you check the tax laws before you send or receive NRI gifts.