Which is the top 1 private bank in India

HDFC Bank

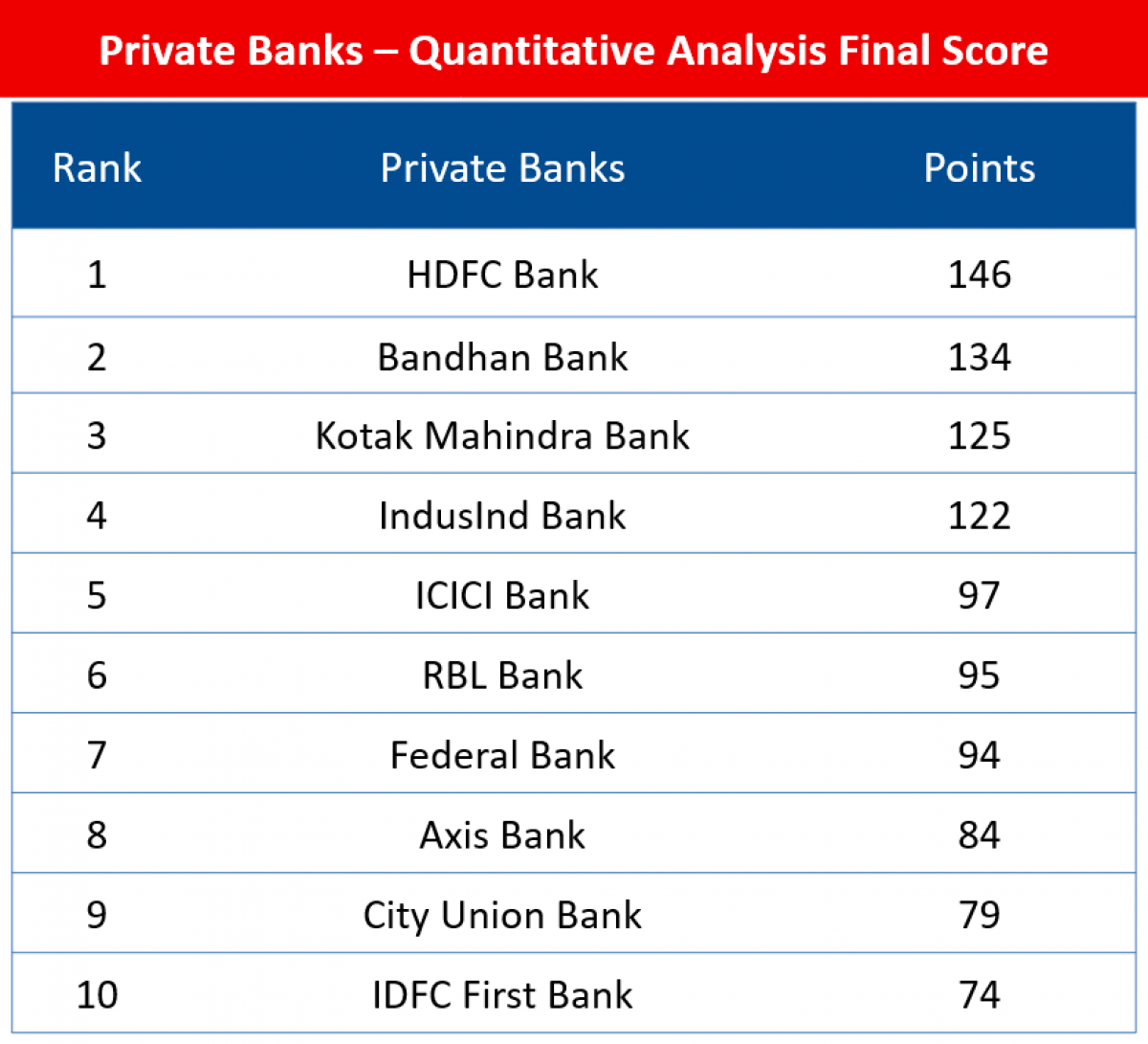

List of Top 10 Best Private Banks in India 2023

| S.No. | Bank Name |

|---|---|

| 1 | HDFC Bank |

| 2 | ICICI Bank |

| 3 | Axis Bank |

| 4 | Kotak Mahindra Bank |

Which is India’s number 1 bank

HDFC

Headquartered in Mumbai, Housing Development Finance Corporation Ltd. HDFC is the largest private sector bank in India at present and also ranked as Number 1 Bank in India according to as per Forbes World's Best Bank survey.

Which is the 1st private banks in India

The first private sector bank in India is Indusland Bank. It was established in 1994 by SP Hinduja, and now it has an excellent banking network with 760 branches in India. Its main focus is to serve NRI customers.

Which is the number 2 private bank in India

List of top 3 private banks according to revenue in the Indian banking system: HDFC bank – 105,161 Cr. ICICI bank – 84,353 Cr. AXIS bank – 56,044 Cr.

Which is the strongest private bank in India

HDFC

HDFC is the largest private bank in India in terms of market capitalisation with total assets of more than 16 trillion rupees.

Which is the 2 largest private bank in India

ICICI BANK

ICICI has the second position in the most leading private sector bank. The bank was founded in the year 1994. Initially, when the bank was established, its name was Industrial Credit and Investment Corporation of India. After a few years, the bank is known as ICICI Bank.

Which is the top 2 bank in India

Top 10 Banks in India HDFC Bank (post-merger) 14,12,055.5. ICICI Bank Ltd 6,53,704.04. State Bank of India 5,11,201.77. Kotak Mahindra Bank Ltd 3,66,967.55. Axis Bank Ltd 3,04,211.88. Indusind Bank Ltd 1,06,707.03. Bank of Baroda 98,436.88. IDBI Bank Ltd 59,482.29.

Which is safest bank in India

RBI had recently released the list of Safest Bank in India. The names of these banks are HDFC, ICICI and SBI. These banks are also called D-SIBs. Along with this, RBI has told where your money is safe.

Which is the 3rd largest private bank in India

Axis Bank

In India, Axis Bank is the third-largest bank in the private sector. They offer in India, such as corporate loaning, syndication, exchange fund, speculation managing an account, and obligation businesses.

Which is the richest Bank of India

HDFC Bank. HDFC Bank is the top bank in India with a market cap of ₹8.78 lakh crore.

Which is the No 3 bank in India

FAQs on Top 10 Banks in India

Based on the extent of their network and financial revenue, the Top 10 Banks in India are Axis Bank Ltd., Bank Of Baroda, Bank of India, IndusInd Bank Ltd., Punjab National Bank, Kotak Mahindra Bank Ltd., State Bank of India, ICICI Bank Ltd., Yes Bank Ltd., and HDFC Bank Ltd.

Why HDFC is better than SBI

Which bank is best SBI or HDFC SBI is preferred for a home loan and HDFC bank is the preferred choice when it comes to personal banking. SBI is known for its low-interest rates whereas HDFC bank is the preferred choice when it comes to the quality of banking services.

Which is the richest private bank in India

As of March 2021, with total assets of more than 15 trillion Indian rupees, HDFC Bank is the largest private sector bank in India. If we consider both the public sector banks and private sector banks, then, State Bank of India (SBI) is the largest bank in India having assets worth more than 40 trillion Indian rupees.

Which is best international bank in India

Best bank for International banking in India. The best banks for international banking in India are American Express Banking Corporation, Barclays Bank Plc, Bank of America, Citibank N.A, Deutsche Bank, DBS Bank India Limited, HSBC Ltd, Standard Chartered Bank, and others.

Which bank is 3rd rank in India

Axis Bank is India's third largest private sector bank that offers financial services for personal and corporate banking. As of April 2022, Axis Bank had 9.96 trillion Indian rupees of assets, giving the bank significant scale.

Which is Asia safest bank in India

In addition, DBS has been accorded the “Safest Bank in Asia” award by Global Finance for 12 consecutive years from 2009 to 2020. DBS provides a full range of services in consumer, SME and corporate banking.

Which bank will never fail in India

RBI continues to classify SBI, ICICI Bank and HDFC Bank in the category of D-SIBs. But, what are D-SIBs These are the banks which are so important for the country's economy that the government cannot afford their collapse. Hence, D-SIBs are thought of as “Too Big to Fail" (TBTF) organisations.

Which is India 2 largest private bank

Which is the Second Largest Private Sector Bank in India ICICI is the second-largest private bank in India with total assets of around 15 trillion INR. It was promoted by ICICI Limited in 1994. The full form of ICICI is the Industrial Credit and Investment Corporation of India.

Which is the most secure bank in India

State Bank of India

Top Banks for FDs in India

| Sr No | List Of Banks | Score |

|---|---|---|

| 1. | State Bank of India | AAA |

| 2. | HDFC Bank | AAA |

| 3. | Bank of Baroda | AAA |

| 4, | ICICI Bank | AAA |

Who is the No 4 bank in India

FAQs on Top 10 Banks in India

Based on the extent of their network and financial revenue, the Top 10 Banks in India are Axis Bank Ltd., Bank Of Baroda, Bank of India, IndusInd Bank Ltd., Punjab National Bank, Kotak Mahindra Bank Ltd., State Bank of India, ICICI Bank Ltd., Yes Bank Ltd., and HDFC Bank Ltd.

Which bank is safe HDFC or SBI

In terms of asset quality, SBI's headline numbers were higher than HDFC Bank. While SBI's gross and net non-performing asset (GNPA, NNPA) ratio stood at 4.50 per cent and 1.34 per cent as on December end, respectively, HDFC Bank's corresponding numbers stood at 1.26 per cent and 0.37 per cent for the same period.

Which is safe HDFC or SBI

Which bank is best SBI or HDFC SBI is preferred for a home loan and HDFC bank is the preferred choice when it comes to personal banking. SBI is known for its low-interest rates whereas HDFC bank is the preferred choice when it comes to the quality of banking services.

Who is the largest private bank

UBS Global Wealth Management

By AUM

| Rank | Bank name | Total assets (2019) (US$ Billion) |

|---|---|---|

| 1 | UBS Global Wealth Management | 2,260.0 |

| 2 | Morgan Stanley Wealth Management | 1,046.0 |

| 3 | Bank of America Global Wealth and Investment Management | 1,021.2 |

| 4 | Credit Suisse Private Banking & Wealth Management | 770.0 |

Which Indian bank is best Forbes

Forbes Advisor Ratings

| Policy Name | Forbes Advisor India Rating | Interest Rate % |

|---|---|---|

| Yes Bank Savings Account | 4.0 | 4 to 5 |

| Advantage Savings Account (Bandhan Bank) | 4.0 | 3 to 6.25 |

| IDFC FIRST Bank | 4.0 | 4 to 5 |

| DCB Bank | 3.5 | 4 to 5 |

Which Indian bank is best for NRI

Best NRE Savings Account for NRIs in 2023

| Name of the Bank | NRE Deposit Interest rates below Rs. 2 crores | |

|---|---|---|

| Axis Bank | 5.15% | 5.40% |

| Bank of Baroda | 4.90% | 5.10% |

| Bank of India | 5.25% | 5.30% |

| Canara Bank | 5.25% | 5.50% |